Skin in the Game

What does it mean for leaders to have “skin in the game”? When their decisions go wrong, when their big ideas fail, who pays the highest price?

I’ve been reading Nassim Nicholas Taleb’s latest book of the same name. Generally, I’m not a big fan of Taleb’s writing: he tends to poke fun at “intellectualistas [and their] elaborate semiabstract buzzword-laden discourse”, which ironically describes his own style perfectly. But this book was recommended by a trusted colleague, so I dug in.

Right from the prologue some observations are hitting home. Taleb highlights the asymmetry of risk/reward in our world, where for an elite few, “heads they win, tails they shout black swan!”

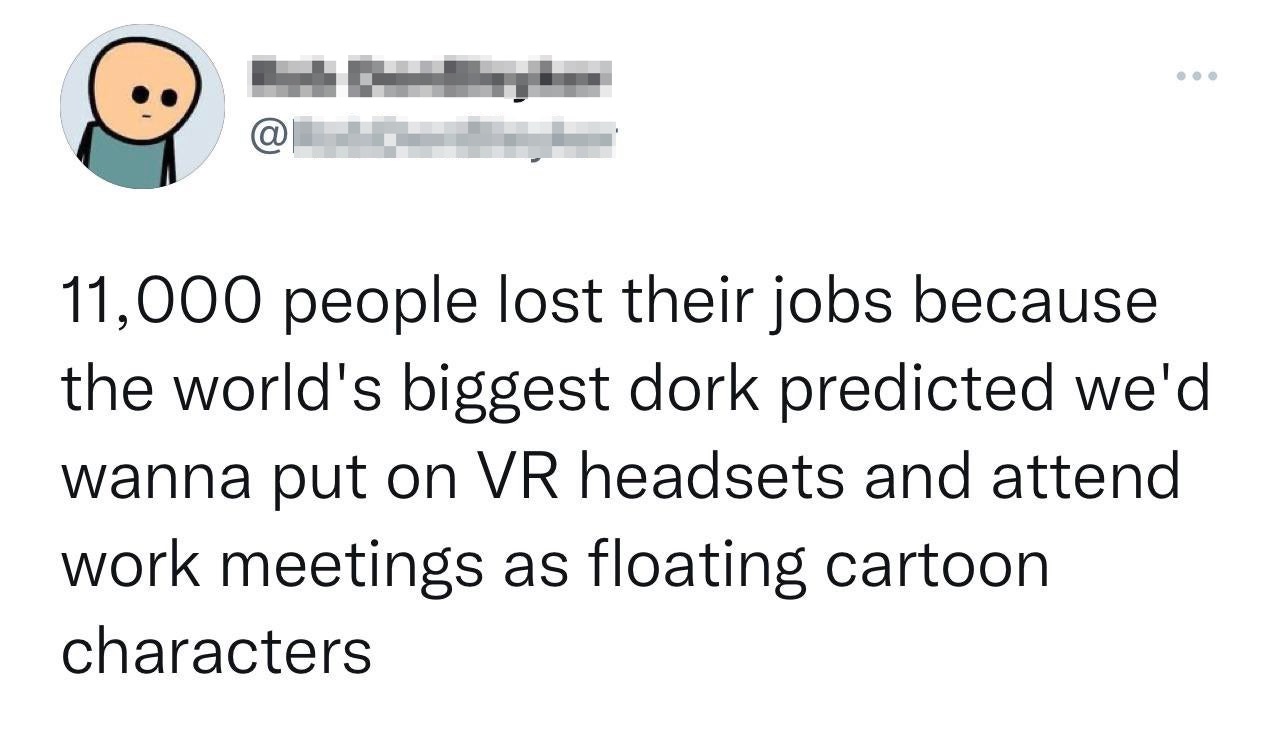

Consider this in view of the recent Big Tech layoffs:

Mark Zuckerberg on Wednesday joined the ranks of tech executives offering a mea culpa, when the chief executive of Facebook parent Meta Platforms Inc. said the company would cut 11,000 workers, or 13% of its staff. Mr. Zuckerberg told employees that he had believed the sharp shift online after the onset of Covid-19 would be permanent. “I got this wrong and I take responsibility for that,” he said.

Days earlier, Twitter Inc. co-founder Jack Dorsey, who ran the company until last year, offered contrition after the social-media platform’s new owner, Elon Musk, cut head count by roughly 50%. “I grew the company size too quickly. I apologize for that,” Mr. Dorsey tweeted on Sunday.

Sam Bankman-Fried, the founder of cryptocurrency trading firm Alameda Research and troubled crypto exchange FTX, on Thursday told employees, “I’m sorry,” as he detailed what had occurred in recent days.

“I take responsibility for choosing to grow our team faster,” Jeff Lawson, CEO of Twilio Inc., said in a September letter to staff when he announced he was cutting 11% of the cloud-communications company’s workforce. “And now, I also own the decision to become more focused — resulting in this layoff.”

It reminds me of the classic Silicon Valley scene where Gavin Belson fires the Nucleus division. Makes you wonder: was the apology authentic, or was it an orchestrated performance?

Disappointingly, even the tech media has overarchingly focused on how the CEOs conducted themselves, not on the missteps that led up to the event, or how the axed people are impacted. Kara Swisher, tech access journalist extraordinaire, said in a recent Pivot podcast about Zuckerberg:

I thought he handled this really well. I like to call ‘em as I see ‘em, and he was empathetic, he signed everything, very generous severance, he did it himself, he was classy about it.

Her co-host, NYU professor and former CEO Scott Galloway (also pompous, but at least he’s right a lot), concurred:

This was a contrast in management competence relative to the shitshow at Twitter. They leaked it to take the pressure off the announcement, then they buried it on the day of the midterms. This was a masterclass from Facebook on how to do this.

Does the “he was classy” thing excuse any of the (continued) blunders at Meta? Could most of those jobs have been saved? Given Meta’s profitability and cash reserves, were the layoffs even necessary? What price, if any, does Zuck pay for this misstep? When times were good, the bonuses and stock compensations rolled into the top floor; but when times are tough, “we need to tighten our belts” and the bottom floor gets axed.

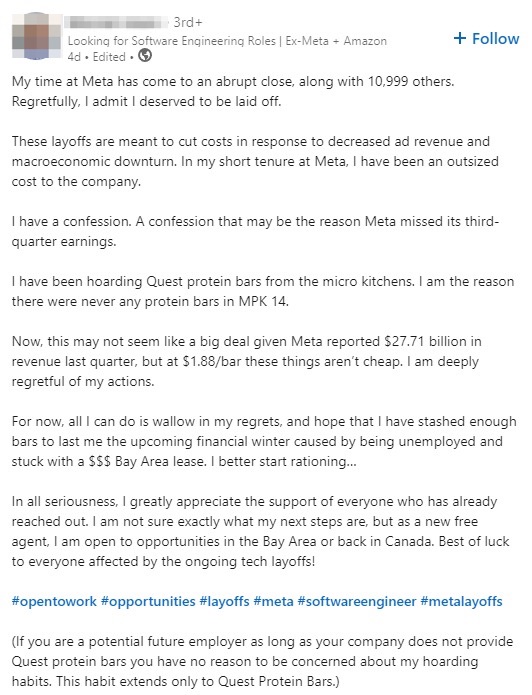

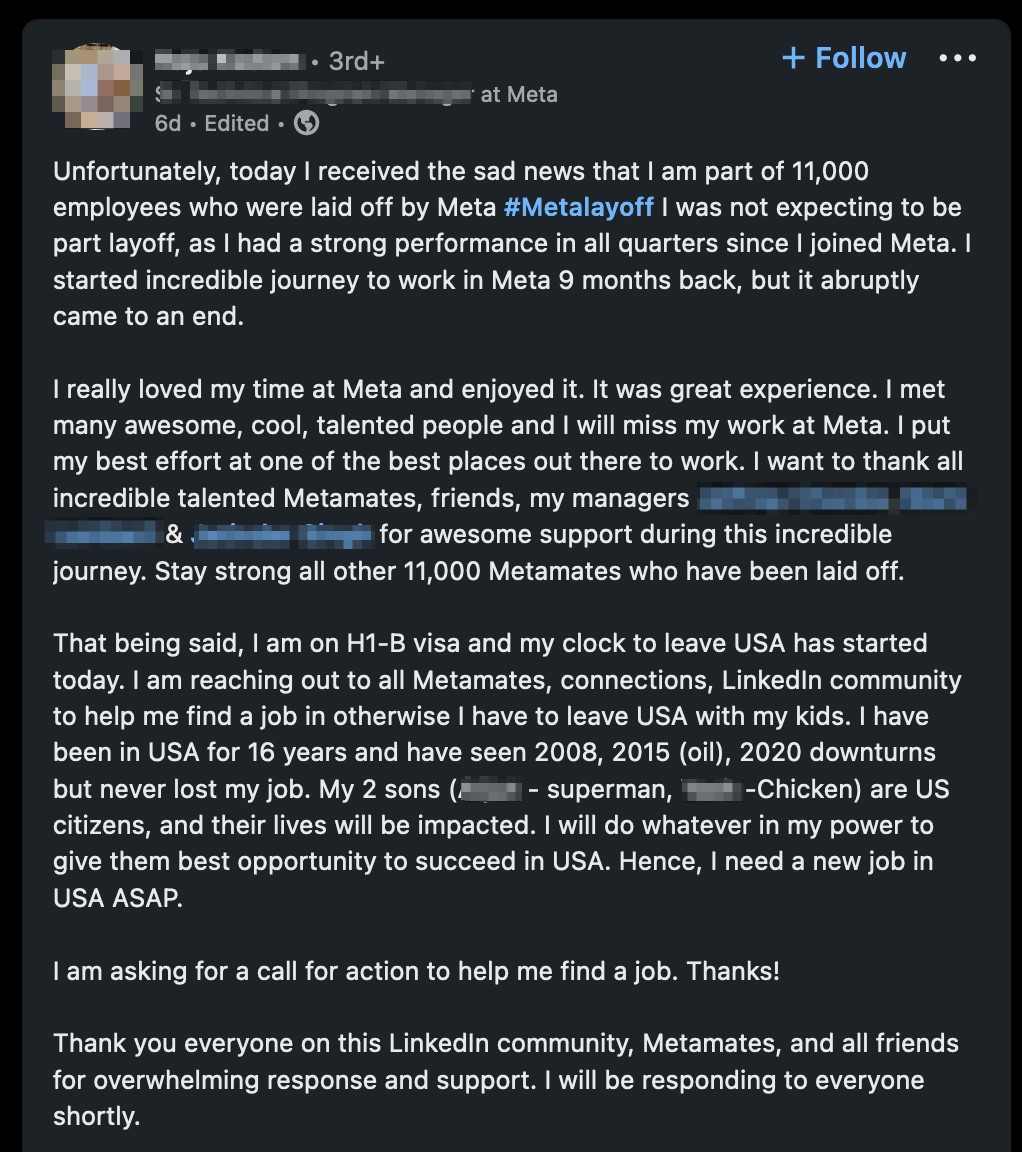

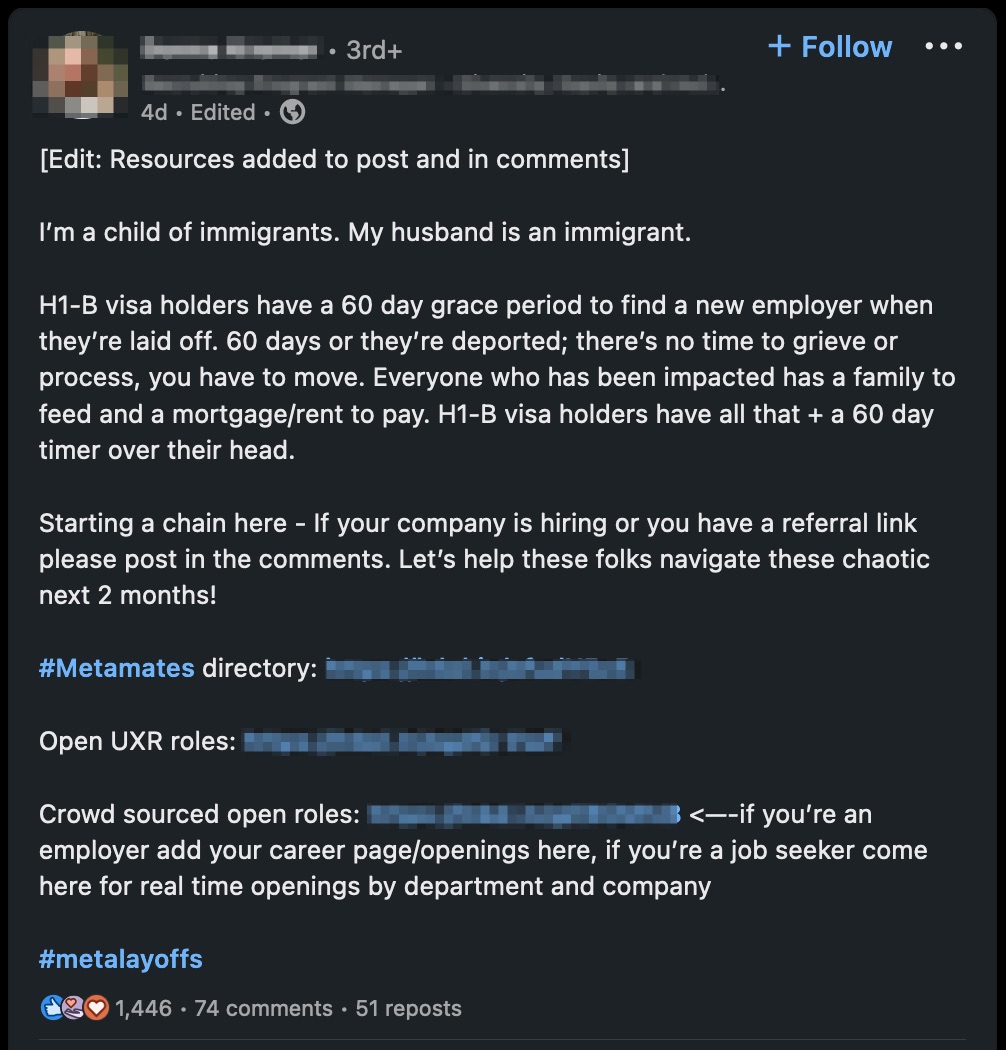

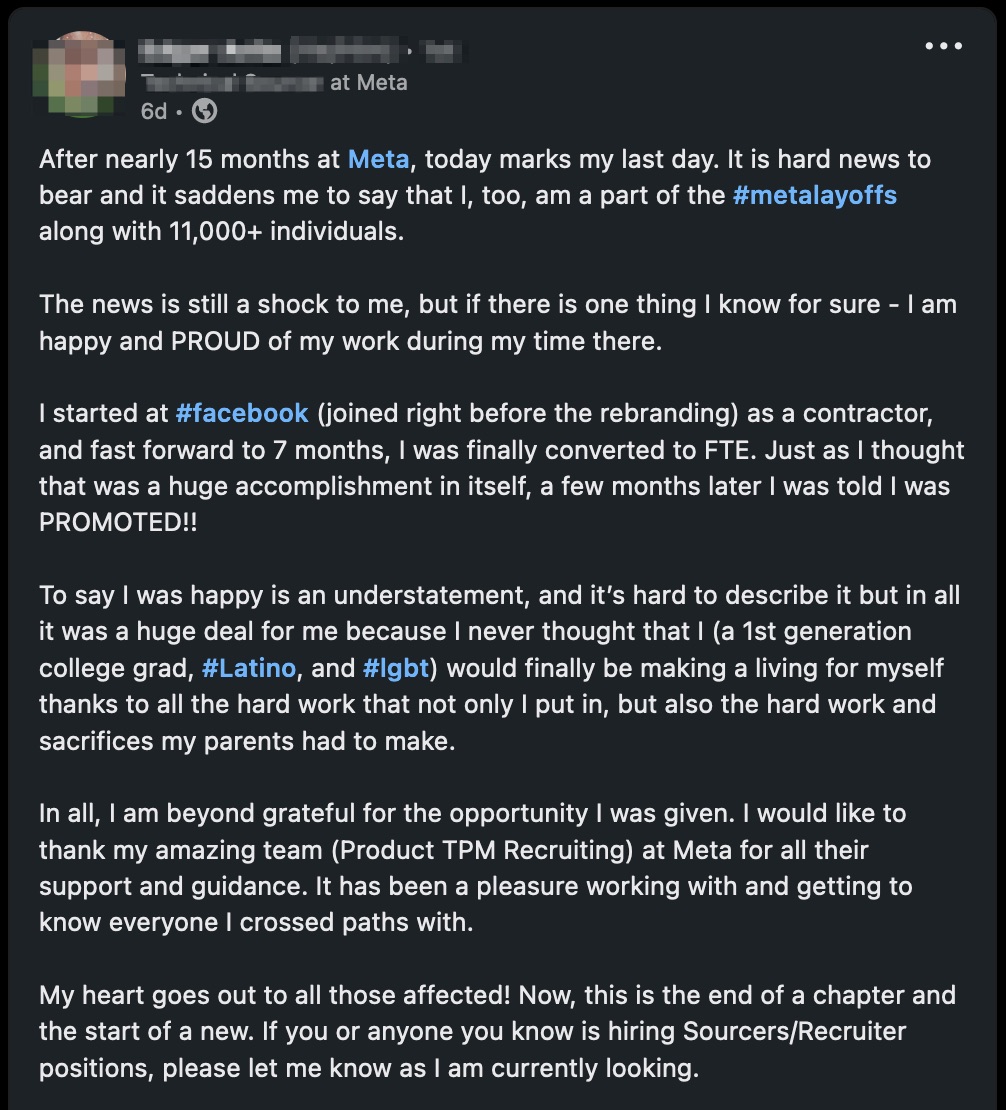

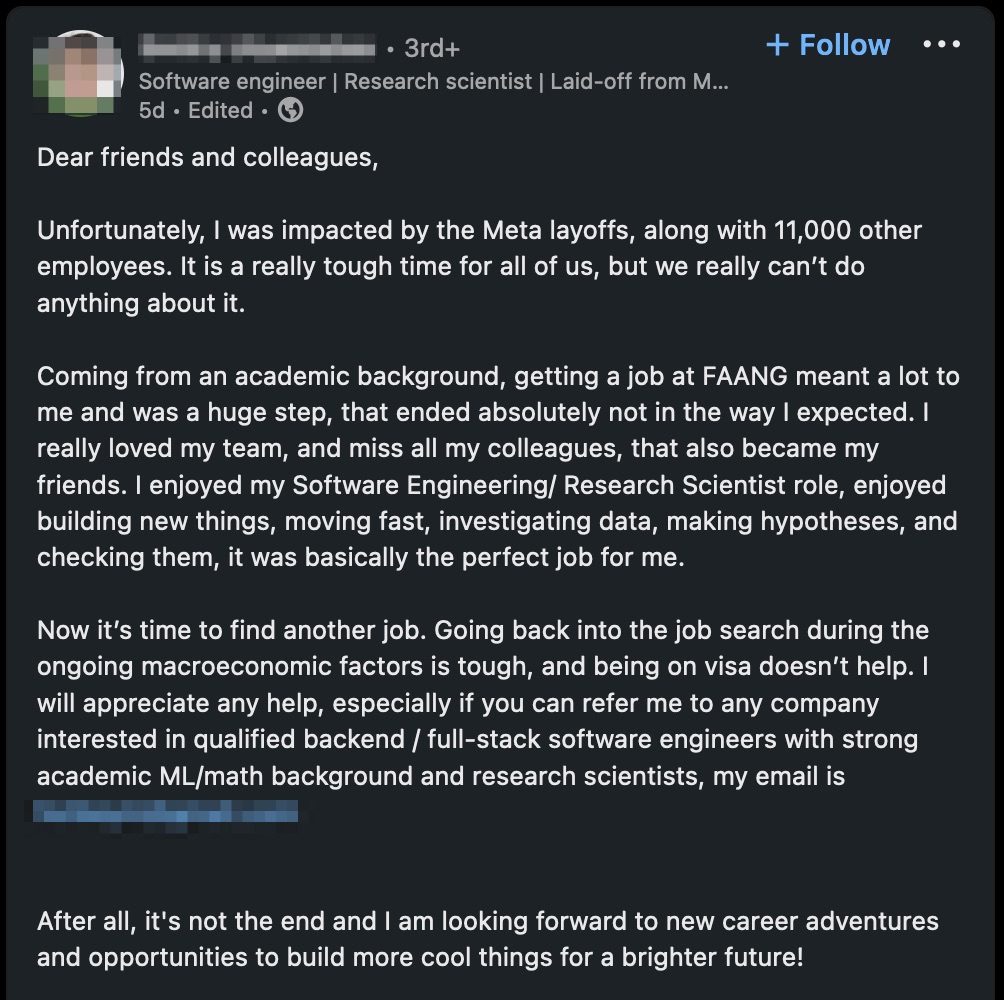

To most of us, the job is not just business, it’s personal. Especially in the US where a person’s healthcare, retirement, and social circles are tied to work; as is (let’s admit) a big part of our ego/identity. Losing a job can be jarring, downright traumatic, leaving people with long-term PTSD. It takes a toll on families. For immigrants it could mean uprooting their entire lives. Seeing the cavalier attitude with which most companies treat layoffs is just sad.

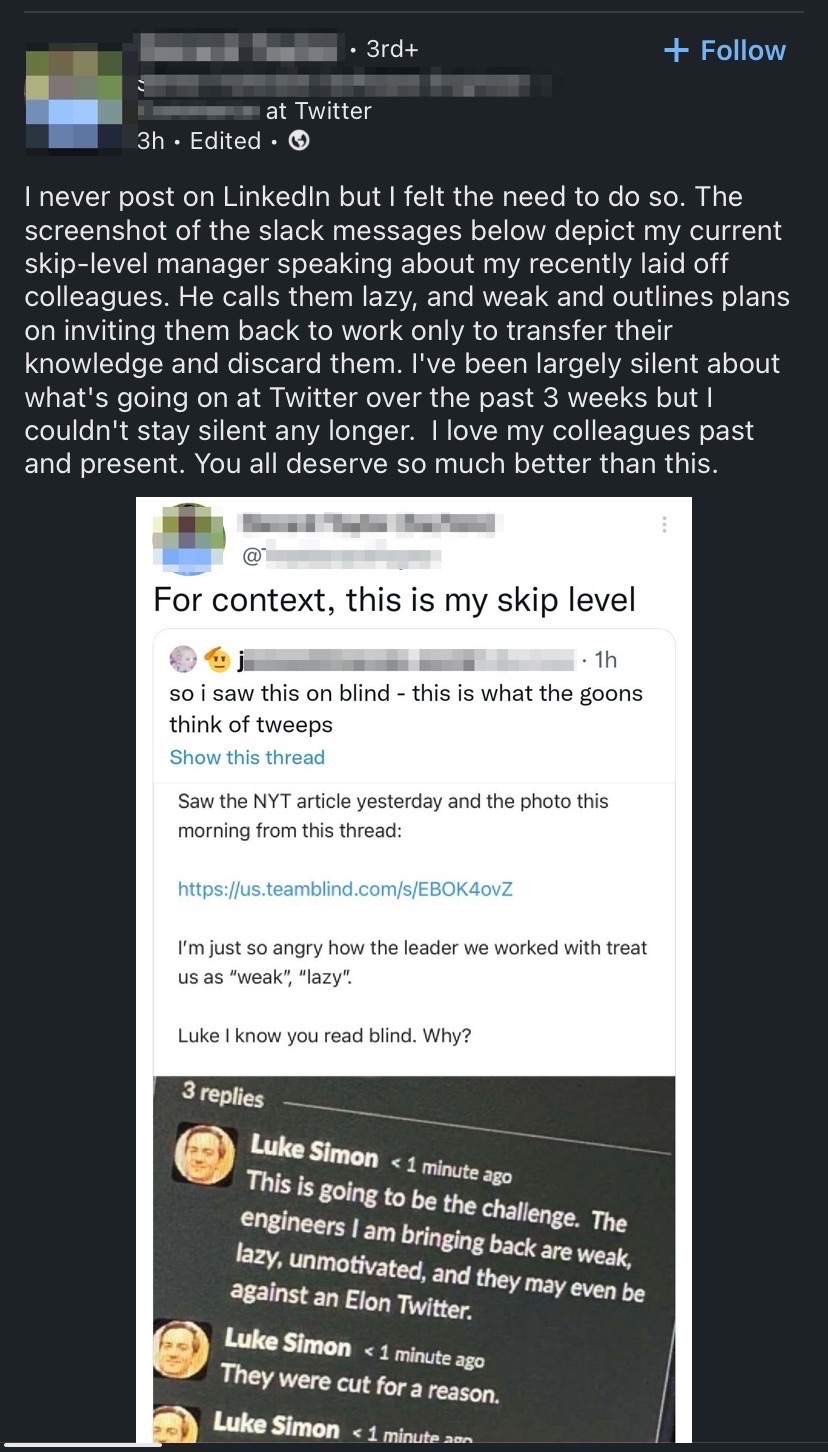

And then there’s the shit show to end all shit shows:

What I want to highlight is the asymmetry here. To Elon this is just a game, some weird public unraveling of his id. But it’s the employees and contractors who paid the price. Ditto with the others - for all their words of contrition and apology, many of them could come out ahead financially (e.g. Meta stock price jumped after the layoffs were announced.) This kind of asymmetric risk/reward seems endemic in our society. Too-big-to-fail banks and companies rake in billions during booms, then get bailed out during busts. Politicians keep getting re-elected despite a track record of incompetence and/or fraud; and if they lose, they just slide into the boards of lobbyist “think tanks”. CEOs who fail miserably get golden parachutes: Marissa Mayer’s disastrous 5 years at Yahoo netted her over $200 million. Adam Neumann “earned” $445 million for running WeWork into the ground, then just 3 years later got a $1 billion valuation for a not-even-launched-yet venture. Peloton founder John Foley left with $225M after his meltdown. Jack Dorsey will make just under $1B from the Twitter sale, after years of weak execution and product mismanagement. Carvana CEO Ernest Garcia III, and his dad (a convicted securities fraudster, and coincidentally the owner of the nation’s 3rd largest second-hand auto dealership), will walk away with billions of investors’ money despite the company’s stock being down 96% since their IPO.

That’s where this line from Taleb hits home:

Skin in the game keeps human hubris in check.

This should be a prerequisite for leadership of any sort. I don’t dispute the need for layoffs during tough economic times, but what did leaders do to lessen the blow for lower-level employees - how they put their skin in the game? And conversely, when times were good, did those same employees get a much larger share of the rewards? And for all of us (we are human after all), is there a decent safety net for when we mess up and need a helping hand?